Candlestick patterns are indispensable tools in technical analysis, offering insights into market trends and potential reversals. One of the more reliable bearish reversal patterns is the Dark Cloud Cover. In this blog, we’ll explore the Dark Cloud Cover candlestick pattern in detail, covering its definition, identification, significance, types, trading strategies, advantages, disadvantages, and limitations. Let’s dive in.

Table of Content

What is a Dark Cloud Cover Pattern?

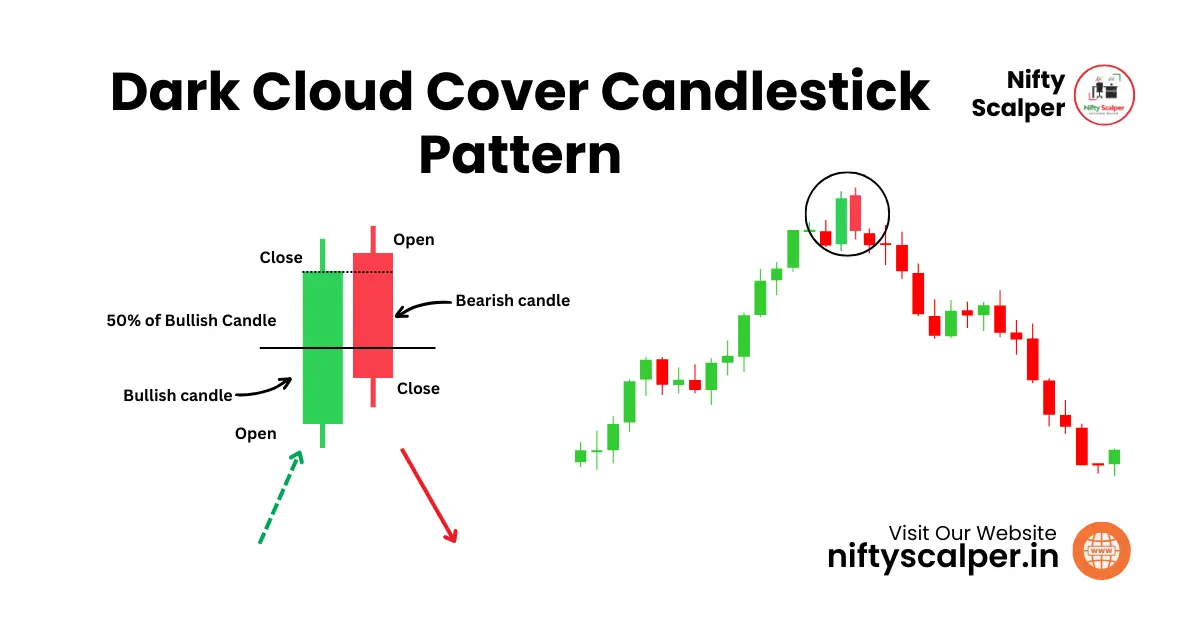

The Dark Cloud Cover is a two-candlestick pattern that signals a potential bearish reversal at the top of an uptrend. It consists of:

- First Candle: A large bullish candle, indicating a continuation of the uptrend.

- Second Candle: A bearish candle that opens above the high of the first candle but closes below its midpoint, indicating a shift in market sentiment from bullish to bearish.

How to Identify a Dark Cloud Cover Candle

To identify a Dark Cloud Cover pattern, look for the following characteristics:

- First Candle: A long bullish candle with a large body, indicating strong buying pressure.

- Second Candle: A bearish candle that opens above the high of the first candle and closes below the midpoint of the first candle’s body.

- Context: The pattern appears after an uptrend, signaling a potential bearish reversal.

Significance of the Dark Cloud Cover Pattern

- The Dark Cloud Cover pattern is significant because it indicates a strong shift in market sentiment. The appearance of the second bearish candle suggests that sellers have entered the market with enough force to counteract the buying pressure. This shift can lead to a bearish trend, making the Dark Cloud Cover pattern a reliable signal for traders looking to capitalize on downward movements.

How to Trade the Dark Cloud Cover Pattern

When trading the Dark Cloud Cover pattern, consider these strategies:

- Confirmation: Wait for the next candlestick to confirm the bearish reversal. A strong bearish candle following the Dark Cloud Cover pattern can validate the anticipated downward move.

- Volume Analysis: Higher trading volume on the second bearish candle adds weight to the pattern, increasing the likelihood of a sustained downward movement.

- Entry Point: Enter the trade near the close of the second bearish candle or at the open of the next candle.

- Risk Management: Use stop-loss orders above the high of the Dark Cloud Cover pattern to manage risk.

Advantages & Disadvantages

Advantages:

- Reliable Reversal Signal: Provides a strong indication of a potential bearish reversal.

- Clear Criteria: Has specific identification criteria, making it easier to spot on candlestick charts.

- Volume Confirmation: Can be confirmed with higher trading volumes, adding to its reliability.

Disadvantages:

- False Signals: May produce false signals in volatile or ranging markets.

- Context-Dependent: Its reliability depends on the preceding uptrend and market conditions.

Limitations and Risks :

While the Dark Cloud Cover pattern is a powerful indicator, it has limitations:

- Market Conditions: In highly volatile markets, the pattern may appear frequently, reducing its reliability.

- Need for Confirmation: Without confirmation, the pattern can lead to incorrect predictions.

- Over-Reliance: Relying solely on Dark Cloud Cover patterns without considering other indicators can result in poor trading decisions.

Conclusion:

The Dark Cloud Cover candlestick pattern is a valuable tool for traders, indicating potential bearish reversals after an uptrend. By understanding how to identify and interpret Dark Cloud Cover patterns, and considering their advantages and limitations, traders can enhance their technical analysis and make more informed trading decisions. Remember, while Dark Cloud Cover patterns are informative, they should be used in conjunction with other analysis tools to mitigate risks and improve accuracy.

By leveraging the insights provided by Dark Cloud Cover candlesticks, traders can better navigate the complexities of the financial markets and improve their trading outcomes.

Remember, successful trading is not just about mastering Dark Cloud Cover pattern; it’s about combining them with Risk Management, Discipline, and Continuous Learning to get the best results in the stock market.