Introduction

The Indian stock market is one of the most dynamic and rapidly growing financial markets in the world. With a plethora of opportunities for traders and investors, it offers a fertile ground for various trading strategies, one of which is equity swing trading. Swing trading is a popular method among traders who aim to capture short- to medium-term gains in a stock (or any financial instrument) over a period of a few days to several weeks. This blog will delve deep into the nuances of swing trading in the Indian stock market, covering everything from the basics to advanced strategies, risk management, and tools of the trade.

What is Swing Trading?

Swing trading is a trading strategy that seeks to capture gains in a stock (or any financial instrument) over a period of a few days to several weeks. Swing traders primarily use technical analysis to look for trading opportunities. Unlike day traders, who close out their positions before the market closes, swing traders may hold their positions for several days or weeks to capitalize on anticipated upward or downward market shifts.

Key Characteristics of Swing Trading:

- Time Horizon: Swing trading typically involves holding positions for a few days to several weeks.

- Technical Analysis: Swing traders rely heavily on technical analysis, using charts, indicators, and patterns to make trading decisions.

- Volatility: Swing traders thrive on market volatility. They look for stocks that are making significant moves in either direction.

- Risk Management: Effective risk management is crucial in swing trading to protect against significant losses.

Why Swing Trading in the Indian Stock Market?

The Indian stock market, with its unique characteristics, offers a conducive environment for swing trading. Here are some reasons why:

- High Liquidity: The Indian stock market is highly liquid, especially in large-cap and mid-cap stocks, making it easier to enter and exit positions.

- Volatility: The Indian market is known for its volatility, which provides ample opportunities for swing traders to capitalize on price movements.

- Diverse Sectors: The Indian market comprises a wide range of sectors, from IT and pharmaceuticals to banking and infrastructure, offering a variety of trading opportunities.

- Regulatory Framework: The Securities and Exchange Board of India (SEBI) ensures a fair and transparent trading environment, which is crucial for swing traders.

Getting Started with Swing Trading in India

1. Understanding the Basics

Before diving into swing trading, it’s essential to understand the basics of the stock market, including how it operates, the different types of orders, and the role of brokers. Familiarize yourself with key concepts such as:

- Stock Exchanges: The two primary stock exchanges in India are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

- Indices: Key indices like the Nifty 50 and the Sensex provide a snapshot of the market’s performance.

- Brokerage Accounts: To trade in the stock market, you’ll need to open a demat and trading account with a registered broker.

2. Setting Up Your Trading Account

Choose a reliable broker that offers a robust trading platform, low brokerage fees, and excellent customer support. Some popular brokers in India include Zerodha, ICICI Direct, HDFC Securities, and Sharekhan.

3. Learning Technical Analysis

Technical analysis is the backbone of swing trading. It involves analyzing historical price and volume data to predict future price movements. Key components of technical analysis include:

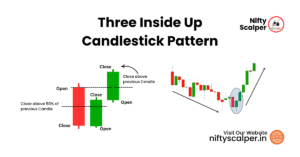

- Charts: Candlestick charts are the most commonly used charts in swing trading. They provide valuable information about price action, including open, high, low, and close prices.

- Indicators: Technical indicators like Moving Averages, Relative Strength Index (RSI), Bollinger Bands, and MACD help traders identify potential entry and exit points.

- Patterns: Chart patterns such as head and shoulders, double tops and bottoms, and triangles can signal potential price movements.

4. Developing a Trading Strategy

A well-defined trading strategy is crucial for success in swing trading. Your strategy should include:

- Entry Points: Identify the conditions under which you will enter a trade. This could be based on technical indicators, chart patterns, or a combination of both.

- Exit Points: Determine when you will exit a trade, either to take profits or cut losses. This could be based on a target price, a stop-loss level, or a change in market conditions.

- Risk Management: Define how much capital you are willing to risk on each trade. A common rule of thumb is to risk no more than 1-2% of your trading capital on a single trade.

5. Paper Trading

Before risking real money, practice your trading strategy using a paper trading account. This allows you to test your strategy in a simulated environment without any financial risk.

Advanced Equity Swing Trading Strategies

Once you have a solid understanding of the basics, you can explore more advanced swing trading strategies. Here are a few popular ones:

1. Trend Following

Trend following is one of the most straightforward and effective swing trading strategies. The idea is to identify stocks that are in a strong uptrend or downtrend and trade in the direction of the trend.

- Uptrend: Look for stocks that are making higher highs and higher lows. Use moving averages (e.g., 50-day or 200-day) to confirm the trend.

- Downtrend: Look for stocks that are making lower highs and lower lows. Again, use moving averages to confirm the trend.

2. Breakout Trading

Breakout trading involves identifying key levels of support and resistance and trading the breakout when the price moves beyond these levels.

- Support: A price level where a stock tends to find buying interest.

- Resistance: A price level where a stock tends to find selling pressure.

- Breakout: When the price moves above resistance or below support, it signals a potential continuation of the trend.

3. Pullback Trading

Pullback trading involves entering a trade after a stock has pulled back from a recent high or low. This strategy allows traders to enter a trend at a more favorable price.

- Uptrend Pullback: Look for stocks that have pulled back to a key support level or moving average before resuming the uptrend.

- Downtrend Pullback: Look for stocks that have pulled back to a key resistance level or moving average before resuming the downtrend.

4. Reversal Trading

Reversal trading involves identifying potential trend reversals and trading in the opposite direction of the prevailing trend. This strategy is riskier but can yield significant profits if executed correctly.

- Bullish Reversal: Look for stocks that have been in a downtrend but show signs of reversing, such as a bullish divergence on the RSI or a breakout above a key resistance level.

- Bearish Reversal: Look for stocks that have been in an uptrend but show signs of reversing, such as a bearish divergence on the RSI or a breakdown below a key support level.

Risk Management in Equity Swing Trading

Risk management is a critical aspect of swing trading. Here are some key risk management principles to follow:

1. Position Sizing

Determine the size of each position based on your risk tolerance and the size of your trading capital. A common rule of thumb is to risk no more than 1-2% of your capital on a single trade.

2. Stop-Loss Orders

Always use stop-loss orders to limit potential losses. A stop-loss order automatically sells your position if the price moves against you by a predetermined amount.

3. Diversification

Avoid putting all your capital into a single stock or sector. Diversify your trades across different stocks and sectors to reduce risk.

4. Risk-Reward Ratio

Before entering a trade, assess the potential risk and reward. A good rule of thumb is to aim for a risk-reward ratio of at least 1:2, meaning you are willing to risk 1tomake1tomake2.

5. Emotional Discipline

Swing trading can be emotionally challenging, especially during periods of market volatility. Stick to your trading plan and avoid making impulsive decisions based on fear or greed.

Tools and Resources for Equity Swing Trading

1. Trading Platforms

A reliable trading platform is essential for executing trades efficiently. Some popular trading platforms in India include:

- Zerodha Kite: Known for its user-friendly interface and low brokerage fees.

- Upstox Pro: Offers advanced charting tools and a seamless trading experience.

- ICICI Direct: Provides a comprehensive trading platform with research and advisory services.

- Fyers: Discount broker with a robust platform for trading in stocks, derivatives, and commodities.

- Dhan: Discount broker with a robust platform for trading in stocks, derivatives, and commodities.

- Angel one: Offers services for equity, mutual funds, and insurance with a user-friendly mobile app.

- Groww: is a modern investment app designed to simplify trading and investing, making it perfect for beginners.

2. Charting Tools

Charting tools are essential for technical analysis. Some popular charting tools include:

- TradingView: Offers advanced charting features and a wide range of technical indicators.

- MetaTrader: A popular platform for technical analysis and automated trading.

- Nest Trader: A widely used platform in India for charting and trading.

3. News and Research

Stay updated with the latest market news and research to make informed trading decisions. Some useful resources include:

- Moneycontrol: Provides comprehensive market news, analysis, and stock recommendations.

- Economic Times: Offers the latest business and financial news.

- Bloomberg Quint: A reliable source for market news and analysis.

4. Educational Resources

Continuous learning is crucial for success in swing trading. Some valuable educational resources include:

- Books: “Technical Analysis of the Financial Markets” by John J. Murphy, “Swing Trading for Dummies” by Omar Bassal.

- Online Courses: Platforms like Coursera, Udemy, and NSE Academy offer courses on technical analysis and swing trading.

- Webinars and Seminars: Attend webinars and seminars conducted by experienced traders and market experts.

Common Mistakes to Avoid in Equity Swing Trading

1. Overtrading

Overtrading is a common mistake among swing traders. It involves taking too many trades, often leading to increased transaction costs and reduced profitability. Stick to your trading plan and avoid the temptation to trade excessively.

2. Ignoring Risk Management

Failing to implement proper risk management can lead to significant losses. Always use stop-loss orders, diversify your trades, and avoid risking too much capital on a single trade.

3. Chasing the Market

Chasing the market involves entering trades based on FOMO (fear of missing out) rather than a well-defined strategy. This often leads to buying at the top or selling at the bottom. Stick to your trading plan and avoid impulsive decisions.

4. Neglecting Fundamental Analysis

While equity swing trading primarily relies on technical analysis, ignoring fundamental analysis can be a mistake. Fundamental factors such as earnings reports, economic data, and geopolitical events can significantly impact stock prices.

5. Lack of Patience

Equity swing trading requires patience and discipline. Avoid the temptation to exit a trade prematurely or hold onto a losing position for too long. Stick to your predefined entry and exit points.

Conclusion

Swing trading in the Indian stock market offers a lucrative opportunity for traders to capitalize on short- to medium-term price movements. However, success in swing trading requires a solid understanding of technical analysis, a well-defined trading strategy, and effective risk management. By following the principles outlined in this blog, you can enhance your chances of success in the dynamic world of equity swing trading.

Remember, swing trading is not a get-rich-quick scheme. It requires continuous learning, practice, and discipline. Start with a solid foundation, practice with a paper trading account, and gradually build your confidence and expertise. With the right approach, swing trading can be a rewarding and profitable endeavor in the Indian stock market.

Happy Trading!