Evening Star Candlestick Pattern

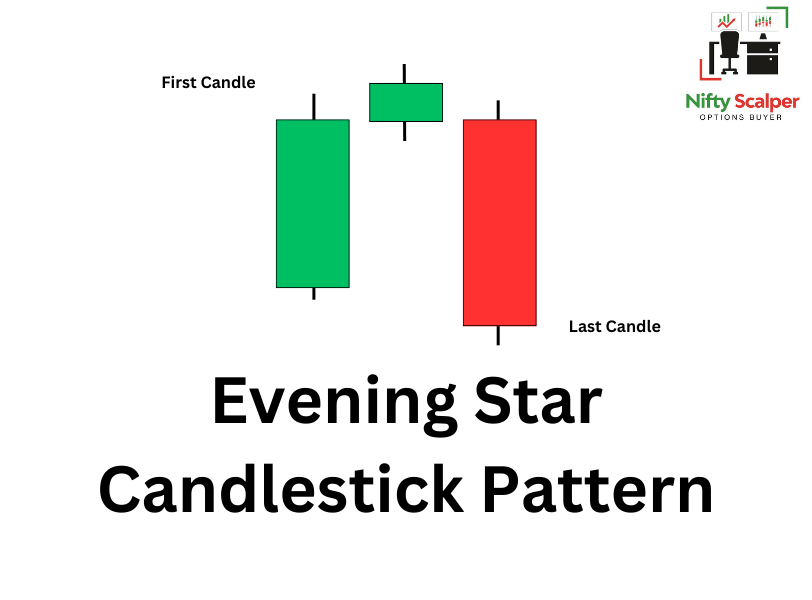

In trading, the Evening Star candlestick pattern is a bearish reversal pattern that often signals a potential trend reversal from an uptrend to a downtrend. It consists of three candlesticks and typically appears at the top of an uptrend.

Here are the key characteristics of the Evening Star candlestick pattern:

- Bullish candlestick: The pattern starts with a relatively large bullish candlestick, which indicates buying pressure and a continuation of the uptrend.

- Doji or small-bodied candlestick: The second candlestick is a small-bodied candlestick, often a Doji, which represents indecision in the market. The opening and closing prices of this candlestick are typically very close or even equal.

- Bearish candlestick: The third candlestick is a bearish candlestick that follows the Doji. It signifies a shift in market sentiment as sellers take control. The bearish candlestick should have a larger body and close at or near its low.

The formation of an Evening Star candlestick pattern suggests that buyers were initially dominant, pushing the price up. However, the indecision represented by the Doji reflects a potential weakening of buying pressure. Finally, the bearish candlestick confirms the reversal as sellers enter the market, pushing the price lower and potentially starting a new downtrend.

Traders often interpret an Evening Star pattern as a signal to consider short or selling positions. However, it’s important to seek confirmation from other technical indicators or patterns and consider the overall market context before making trading decisions.

Different types of Evening Star Candlestick Pattern

How to Trade Evening Star Candlestick Pattern

To trade the Evening Star candlestick pattern, you can consider the following steps:

- Identify the Evening Star pattern: Look for a large bullish candlestick followed by a Doji or small-bodied candlestick and then a larger bearish candlestick.

- Confirm the pattern: Seek confirmation from other indicators or patterns, such as trendlines, moving averages, or support and resistance levels, to validate the bearish reversal signal.

- Consider volume: Analyze the trading volume accompanying the Evening Star pattern. Higher volume during the formation adds credibility to the bearish signal, indicating increased selling interest.

- Set entry and exit points: Determine your entry point based on the confirmation signals and establish stop-loss and take-profit levels to manage your risk. The stop-loss is typically placed above the high of the Evening Star pattern, while the take-profit level can be set based on your risk-reward ratio or key support levels.

- Manage your position: Monitor the trade closely and adjust your stop-loss and take-profit levels as the price progresses. Consider trailing your stop-loss to protect profits if the trade moves in your favor.

As with any trading pattern, it’s important to practice proper risk management, conduct thorough analysis, and consider multiple factors before making trading decisions. Additionally, combining the Evening Star pattern with other technical analysis tools can help increase the probability of accurate trades.

Pingback: Hammer Candlestick - Top patterns to make money from market - Nifty Scalper