Inverted Hammer Candlestick Pattern

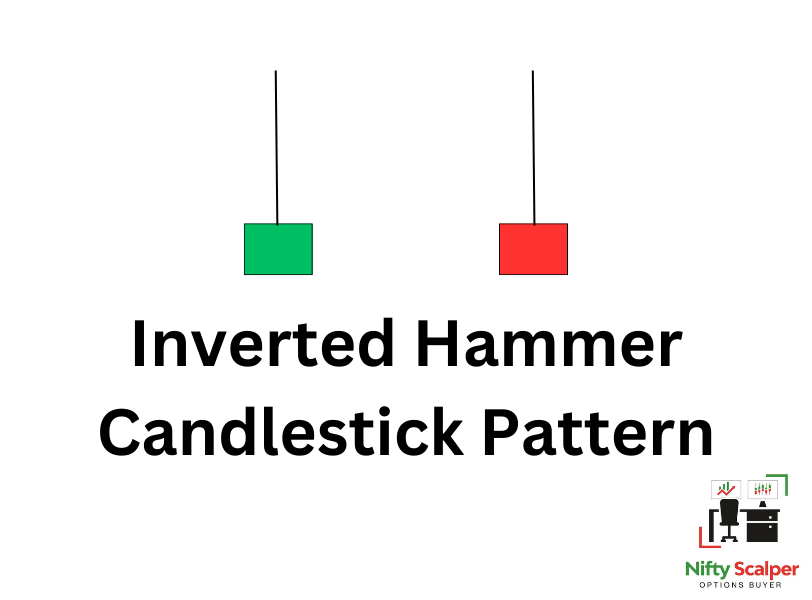

In trading, an inverted hammer candle is a specific candlestick pattern that can provide insight into potential market reversals. It is considered a bullish reversal signal when it appears after a uptrend. The inverted hammer candlestick is characterized by a small body, a long upper shadow, and little to no lower shadow.

Here are the key characteristics of an inverted hammer candle:

- Small body: The body of the candlestick is relatively small compared to the overall length of the candlestick. It is usually located near the bottom end of the candlestick.

- Long upper shadow: The candlestick has a long upper shadow, which represents the price range between the session’s high and the closing price. The upper shadow is typically at least twice as long as the body of the candlestick.

- Little to no lower shadow: Ideally, there should be little to no lower shadow, indicating that the price closed near its low for the session.

The formation of an inverted hammer candle suggests that buying pressure was initially strong, causing the price to incline during the trading session. However, sellers stepped in and pushed the price back down, resulting in a selling by the end of the session. This potential shift in sentiment from bullish to bearish can indicate a reversal in the uptrend.

Traders often interpret an inverted hammer candle as a signal to consider short or selling positions, particularly if it forms near a significant resistance level. However, like other candlestick patterns, a single inverted hammer candle is not enough to make trading decisions. Confirmation from other technical indicators or patterns, as well as consideration of the overall market context, is typically sought before taking action.

Traders often interpret an inverted hammer candle as a signal to consider short or selling positions, particularly if it forms near a significant resistance level. However, like other candlestick patterns, a single inverted hammer candle is not enough to make trading decisions. Confirmation from other technical indicators or patterns, as well as consideration of the overall market context, is typically sought before taking action.

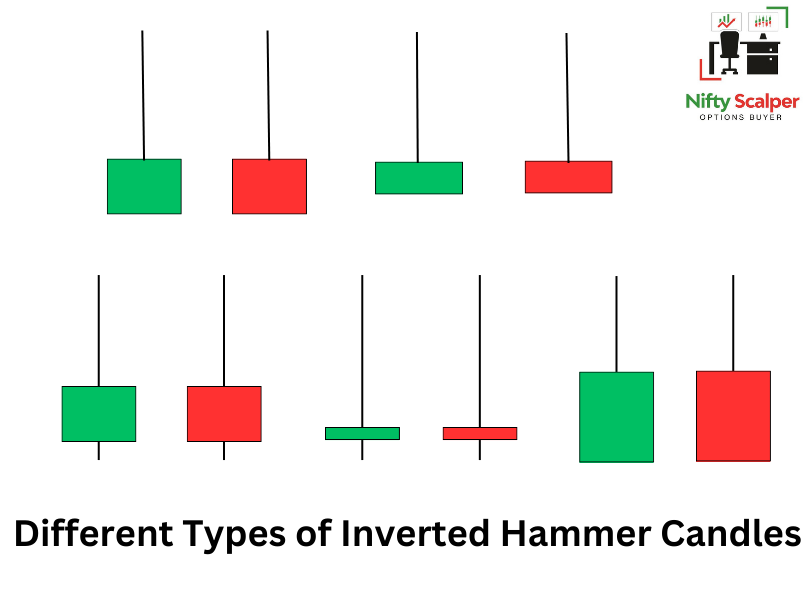

Different types of Inverted Hammer candlesticks

How to Trade Inverted Hammer Candlestick

Trading an inverted hammer candle involves a combination of pattern recognition, confirmation signals, and risk management. Here are some steps to consider when trading an inverted hammer candle:

- Identify the inverted hammer candle: Look for a candlestick with a small body, a long upper shadow, and little to no lower shadow. The inverted hammer candle should appear after a uptrend, indicating a potential reversal.

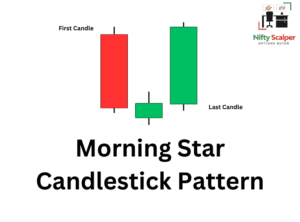

- Confirm the pattern: While an inverted hammer candle suggests a bullish reversal, it’s essential to seek confirmation from other technical indicators or patterns. Consider factors such as trendlines, support and resistance levels, and volume.

- Look for resistance levels: Identify nearby resistance levels that can further strengthen the bearish case. If the inverted hammer candle forms near a significant resistance level, it adds more weight to the potential reversal.

- Analyze the volume: Evaluate the trading volume accompanying the inverted hammer candle. Higher volume during the formation indicates increased selling interest and reinforces the bearish signal.

- Wait for confirmation: To reduce the risk of false signals, it’s often prudent to wait for confirmation before entering a trade. Look for confirmation by observing the price action in the following sessions. Ideally, the price should close lower or break below a key resistance level.

- Set stop-loss and take-profit levels: Determine your risk tolerance and set appropriate stop-loss levels above the inverted hammer candle’s high or the nearest resistance level. Establish a target for taking profits based on your risk-reward ratio and the potential price movement.

- Manage your position: Once you enter a trade, monitor it closely and adjust your stop-loss and take-profit levels as the price progresses. Consider trailing your stop-loss to protect profits if the trade moves in your favor.

- Combine with other strategies: Inverted hammer candles work best when used in conjunction with other technical analysis tools and strategies. Consider using indicators like moving averages, trendlines, or oscillators to strengthen your trading decisions.

It’s important to note that trading involves risks, and no trading signal or pattern guarantees success. Practice proper risk management, conduct thorough analysis, and continually educate yourself to make informed trading decisions. Additionally, consider backtesting and paper trading to validate the effectiveness of the inverted hammer candle pattern within your trading strategy.

Pingback: Hammer Candlestick - Top patterns to make money from market - Nifty Scalper