Title: Strategies for Capitalizing on Stock Trends with Long Call and Long Put Options

Introduction:

Long call and long put options are versatile strategies that allow traders to capitalize on directional movements in stock prices. This guide explores how to effectively use long call and long put options to benefit from upward and downward trends in the stock market, providing insights into strategy development, risk management, and practical considerations.

1. Long Call Option Strategy: Riding the Upside

Objective:

- Capitalizing on Bullish Trends: Profit from an anticipated upward movement in the stock price.

Execution:

- Buy Call Options: Purchase call options to gain the right to buy the underlying stock at a specified strike price.

Considerations:

- Strike Price Selection: Choose a strike price above the current stock price to enhance potential profits.

- Expiration Date: Align the expiration date with the expected duration of the bullish trend.

Risk Management:

- Limited Risk: The maximum loss is limited to the premium paid for the call options.

- Monitoring Position: Regularly assess the stock’s performance and adjust the strategy if market conditions change.

2. Long Put Option Strategy: Profiting from Downtrends

Objective:

- Benefiting from Bearish Trends: Profit from an anticipated downward movement in the stock price.

Execution:

- Buy Put Options: Acquire put options to gain the right to sell the underlying stock at a specified strike price.

Considerations:

- Strike Price Selection: Choose a strike price below the current stock price for increased profit potential.

- Expiration Date: Align the expiration date with the expected duration of the bearish trend.

Risk Management:

- Limited Risk: The maximum loss is restricted to the premium paid for the put options.

- Monitoring Position: Regularly assess the stock’s performance and adjust the strategy based on evolving market conditions.

3. Combining Long Call and Long Put Options: Creating a Straddle Strategy

Objective:

- Profiting from Significant Price Movement: Benefit from volatility, regardless of the direction of the stock price.

Execution:

- Buy Both Call and Put Options: Simultaneously purchase a call option and a put option with the same strike price and expiration date.

Considerations:

- Volatility Expectations: Implement the straddle strategy when anticipating significant price movement.

- Cost Management: Be mindful of the combined cost of the call and put options.

Risk Management:

- Limited Risk: The maximum loss is confined to the total premium paid for both options.

- Managing Volatility Changes: Adjust the strategy if market conditions result in changes to implied volatility.

4. Adjusting Strategies for Changing Trends:

1. Rolling Options:

- Objective: Extend the duration of the position if the trend continues.

- Execution: Roll options by closing existing positions and opening new ones with later expiration dates.

2. Closing Positions:

- Objective: Lock in profits or limit losses if the trend reverses.

- Execution: Close options positions based on predefined profit targets or stop-loss levels.

5. Market Timing and Research:

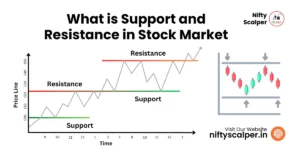

1. Technical Analysis:

- Objective: Use technical indicators to identify trends and potential reversal points.

- Execution: Employ tools such as moving averages, trendlines, and support/resistance levels.

2. Fundamental Analysis:

- Objective: Consider fundamental factors that may impact the stock’s direction.

- Execution: Analyze earnings reports, economic indicators, and industry trends.

Conclusion:

Long call and long put options provide traders with powerful tools to capitalize on stock trends, whether bullish or bearish. By carefully selecting strike prices, expiration dates, and employing risk management strategies, traders can align their options positions with their market expectations. Additionally, the flexibility to adjust strategies based on changing trends and market conditions enhances the overall effectiveness of long call and long put options in capturing profit opportunities. Continuous monitoring, market research, and a disciplined approach contribute to successful implementation of these strategies in dynamic stock market environments.