Morning Star Candlestick Pattern

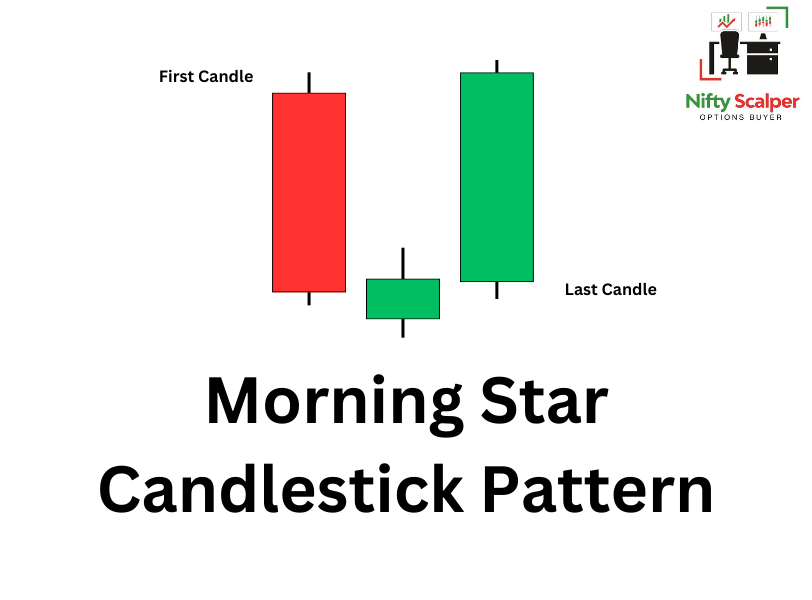

In trading, the Morning Star candlestick pattern is a bullish reversal pattern that often signals a potential trend reversal from a downtrend to an uptrend. It consists of three candlesticks and typically appears at the bottom of a downtrend.

Here are the key characteristics of the Morning Star candlestick pattern:

- Bearish candlestick: The pattern starts with a relatively large bearish candlestick, which indicates selling pressure and a continuation of the downtrend.

- Doji or small-bodied candlestick: The second candlestick is a small-bodied candlestick, often a Doji, which represents indecision in the market. The opening and closing prices of this candlestick are typically very close or even equal.

- Bullish candlestick: The third candlestick is a bullish candlestick that follows the Doji. It signifies a shift in market sentiment as buyers take control. The bullish candlestick should have a larger body and close at or near its high.

The formation of a Morning Star candlestick pattern suggests that sellers were initially dominant, pushing the price down. However, the indecision represented by the Doji reflects a potential weakening of selling pressure. Finally, the bullish candlestick confirms the reversal as buyers step in, pushing the price higher and potentially starting a new uptrend.

Traders often interpret a Morning Star pattern as a signal to consider long or buying positions. However, it’s important to seek confirmation from other technical indicators or patterns and consider the overall market context before making trading decisions.

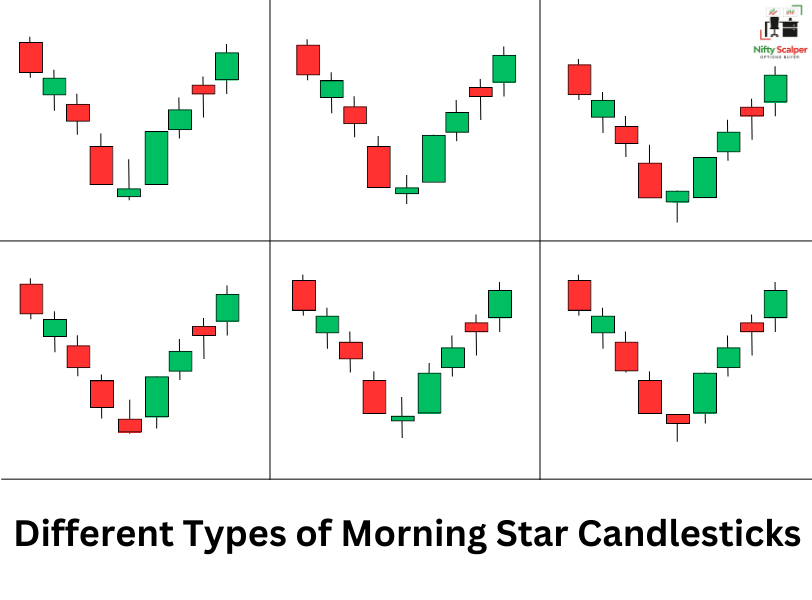

Different types of Morning Star Candlestick Pattern

How to Trade Morning Star Candlestick Pattern

To trade the Morning Star candlestick pattern, you can consider the following steps:

- Identify the Morning Star pattern: Look for a large bearish candlestick followed by a Doji or small-bodied candlestick and then a larger bullish candlestick.

- Confirm the pattern: Seek confirmation from other indicators or patterns, such as trendlines, moving averages, or support and resistance levels, to validate the bullish reversal signal.

- Consider volume: Analyse the trading volume accompanying the Morning Star pattern. Higher volume during the formation adds credibility to the bullish signal, indicating increased buying interest.

- Set entry and exit points: Determine your entry point based on the confirmation signals and establish stop-loss and take-profit levels to manage your risk. The stop-loss is typically placed below the low of the Morning Star pattern, while the take-profit level can be set based on your risk-reward ratio or key resistance levels.

- Manage your position: Monitor the trade closely and adjust your stop-loss and take-profit levels as the price progresses. Consider trailing your stop-loss to protect profits if the trade moves in your favour.

It’s important to practice proper risk management, conduct thorough analysis, and consider multiple factors before making trading decisions. Additionally, combining the Morning Star pattern with other technical analysis tools can help increase the probability of accurate trades.

Pingback: Hammer Candlestick - Top patterns to make money from market - Nifty Scalper