Candlestick patterns are vital tools for traders in technical analysis, providing insights into market sentiment and potential price movements. One such pattern, the Spinning Top, is particularly useful for identifying periods of indecision in the market. In this blog, we’ll explore the Spinning Top candlestick pattern in detail, covering its definition, identification, significance, types, trading strategies, advantages, disadvantages, and limitations. Let’s get started.

Table of Content

What is a Spinning Top?

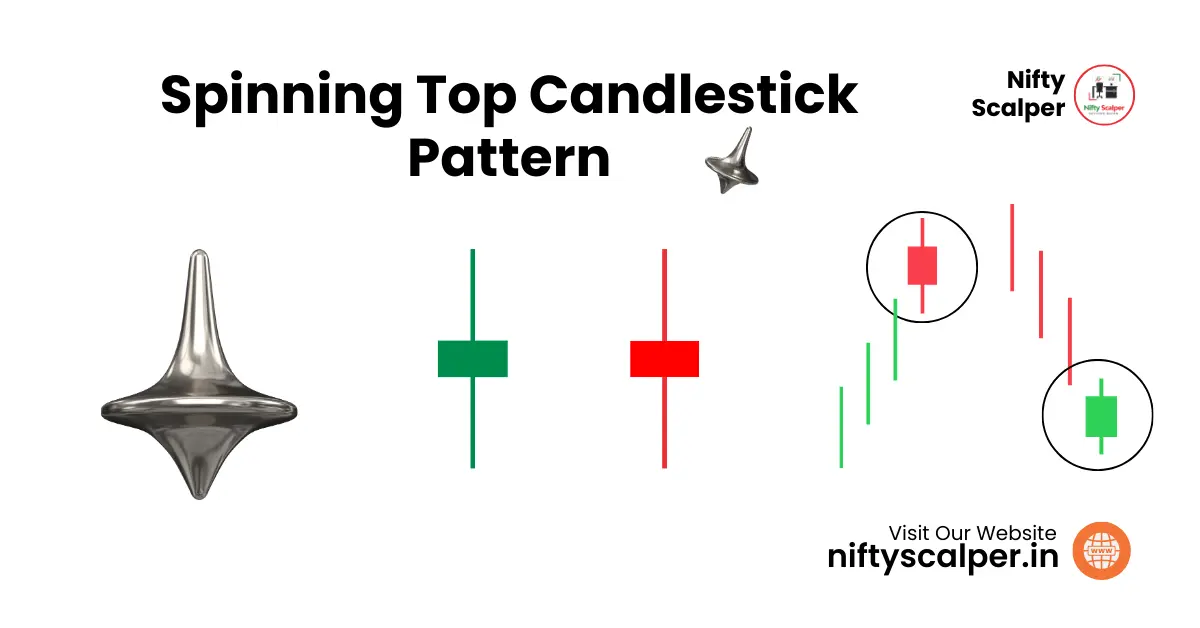

A Spinning Top is a candlestick pattern characterized by a small body centered between long upper and lower shadows. This pattern indicates that neither the bulls nor the bears could gain control, resulting in a stalemate. The Spinning Top often signifies indecision in the market and can appear during both uptrends and downtrends.

How to Identify a Spinning Top Candle

To identify a Spinning Top candlestick, look for the following features:

- Body: A small body, indicating a minimal difference between the open and close prices.

- Shadows: Long upper and lower shadows, reflecting significant price movements in both directions during the trading period.

- Shape: The overall shape looks balanced, with the body in the middle and shadows of approximately equal length on either side.

Significance of the Spinning Top in Stock Market:

- The Spinning Top is significant because it highlights a period of market indecision. This pattern suggests that the current trend may be losing momentum, and a reversal or consolidation might occur. Traders use the Spinning Top to assess potential changes in market direction and to gauge the sentiment of market participants.

Types of Spinning Top Candles in Stock Market :

There are no specific subtypes of Spinning Tops, but the pattern can appear in various contexts:

- Bullish Spinning Top: Appears in an uptrend, indicating potential reversal or consolidation.

- Bearish Spinning Top: Appears in a downtrend, suggesting possible reversal or consolidation.

How to Trade the Spinning Top Candlestick in Stock Market :

When trading the Spinning Top, consider these strategies:

- Confirmation: Wait for the next candlestick to confirm the market’s direction. A strong bullish or bearish candle following the Spinning Top can validate the anticipated move.

- Context Analysis: Analyze the Spinning Top within the broader market context. Combine it with other technical indicators and chart patterns to support your trading decisions.

- Risk Management: Use appropriate stop-loss orders to manage risk, especially given the inherent uncertainty a Spinning Top represents.

Advantages & Disadvantages

Advantages:

- Early Warning: Provides an early indication of potential trend reversals or consolidations.

- Simplicity: Easy to identify on candlestick charts.

- Flexibility: Can be used in various market conditions and timeframes.

Disadvantages:

- Indecisiveness: Indicates market indecision, which can lead to false signals.

- Context-Dependent: Its significance is heavily dependent on the preceding trend and surrounding candlesticks.

Limitations and Risks :

While the Spinning Top is valuable, it has limitations:

- False Signals: Without confirmation, a Spinning Top can lead to incorrect predictions.

- Market Noise: In volatile markets, Spinning Tops may appear frequently, reducing their reliability.

- Over-Reliance: Relying solely on Spinning Tops without considering other indicators can result in poor trading decisions.

Conclusion:

The Spinning Top candlestick pattern is an essential tool for traders, highlighting moments of market indecision that can signal potential reversals or consolidations. By understanding how to identify and interpret Spinning Tops, and considering their advantages and limitations, traders can enhance their technical analysis and make more informed trading decisions. Remember, while Spinning Tops are informative, they should be used in conjunction with other analysis tools to mitigate risks and improve accuracy.

By leveraging the insights provided by Spinning Top candlesticks, traders can better navigate the complexities of the financial markets and improve their trading outcomes.

Remember, successful trading is not just about mastering Spinning Top Candlestick Pattern; it’s about combining them with Risk Management, Discipline, and Continuous Learning to get the best results in the stock market.