Introduction

* Why Stock market analysis is critical for making informed investment decisions.

* Overview of fundamental and technical analysis and their importance.

Part 1: Fundamental Analysis in Stock Market Analysis

1.1 Key Metrics

- PE Ratio (Price-to-Earnings Ratio)

- Definition: The PE ratio measures how much investors are willing to pay for each rupee of earnings generated by the company. It’s a crucial metric for evaluating whether a stock is overvalued, undervalued, or fairly valued.

- Formula: PE Ratio=Market Price per Share /Earnings per Share (EPS)

- Understanding PE Ratio:

- A high PE ratio may indicate that the stock is overpriced or that investors expect high future growth.

- A low PE ratio might suggest that the stock is undervalued or the company has lower growth expectations.

- Example:

If a stock is trading at ₹200 per share and its EPS is ₹10, the PE Ratio = ₹200/₹10 = 20. This means investors are willing to pay ₹20 for every ₹1 of the company’s earnings. - Use in Analysis:

Compare the PE ratio with the industry average or peers to assess its relative valuation.

- EPS (Earnings per Share)

- Definition: EPS measures a company’s profitability on a per-share basis, making it easier to compare companies regardless of their size.

- Formula: EPS=(Net Profit – Dividends on Preferred Stock) / Total Shares Outstanding

- Types of EPS:

- Basic EPS: Based on the current number of outstanding shares.

- Diluted EPS: Accounts for potential shares from options, convertible debt, etc.

- Example:

If a company earns ₹50 crore in net profit and has 5 crore outstanding shares, its EPS = ₹50 crore / 5 crore = ₹10 per share. - Use in Analysis:

- Growing EPS over time indicates increasing profitability.

- Compare EPS across years and competitors for trend analysis.

- PB Ratio (Price-to-Book Ratio)

- Definition: The PB ratio compares a stock’s market value to its book value. It reflects how much investors are paying for each rupee of the company’s net assets.

- Formula: PB Ratio=Market Price per Share / Book Value per Share

- Book Value per Share (BVPS): BVPS=(Total Assets – Total Liabilities) / Total Shares Outstanding

- Understanding PB Ratio:

- A PB ratio of less than 1 may indicate the stock is undervalued relative to its assets.

- A PB ratio of greater than 1 suggests investors are willing to pay a premium for the company’s assets, possibly due to growth prospects.

- Example:

If a stock’s market price is ₹150, and its book value per share is ₹100, the PB Ratio = ₹150/₹100 = 1.5. - Use in Analysis:

Often used for asset-heavy industries like banking, real estate, or manufacturing. It is less relevant for tech companies where intangible assets dominate.

Part 2: Technical Analysis in Stock Market Analysis

2.1 Charts and Patterns

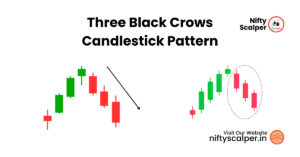

Candlestick Charts

Candlestick charts visually represent price movements over a specific time period, displaying the opening, closing, high, and low prices.

Key Patterns:

- Doji:

- Appears when the opening and closing prices are nearly the same.

- Indicates market indecision and potential trend reversals.

- Hammer:

- A small body with a long lower shadow, appearing after a downtrend.

- Suggests a potential bullish reversal.

- Shooting Star:

- A small body with a long upper shadow, appearing after an uptrend.

- Signals a potential bearish reversal.

- Engulfing Patterns:

- Bullish Engulfing: A larger green candle engulfs the prior smaller red candle, indicating a reversal to the upside.

- Bearish Engulfing: A larger red candle engulfs the prior smaller green candle, signaling a reversal to the downside.

Importance:

Candlestick patterns help identify market sentiment and potential reversals or continuations in trends.

Support and Resistance Levels

- Support: A price level where demand is strong enough to prevent further decline.

- Example: If a stock repeatedly bounces back from ₹100, ₹100 becomes a support level.

- Resistance: A price level where selling pressure prevents further price increases.

- Example: If a stock struggles to break ₹200 repeatedly, ₹200 becomes a resistance level.

Importance:

These levels are crucial for planning entry and exit points, as well as setting stop-loss and target levels.

Trendlines

- Uptrend: A series of higher highs and higher lows.

- Downtrend: A series of lower highs and lower lows.

- Sideways Trend: Price moves within a defined horizontal range.

Importance:

Trendlines help identify the overall market direction, making it easier to align trades with the prevailing trend.

2.2 Indicators

1. Moving Averages (MA)

- Simple Moving Average (SMA): The average price over a specific period (e.g., 50-day SMA).

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to recent trends.

Application:

- Identify trends: Prices above the MA indicate an uptrend, while prices below it indicate a downtrend.

- Crossover signals: A short-term MA crossing above a long-term MA signals a buy, while the reverse signals a sell.

2. Relative Strength Index (RSI)

- RSI ranges from 0 to 100.

- Overbought Zone (>70): Indicates the stock might be overvalued and due for a correction.

- Oversold Zone (<30): Indicates the stock might be undervalued and due for a bounce.

Application:

Combines well with price action to confirm trends or reversals.

3. MACD (Moving Average Convergence Divergence)

- Consists of the MACD line, signal line, and histogram.

- Buy Signal: When the MACD line crosses above the signal line.

- Sell Signal: When the MACD line crosses below the signal line.

Application:

Tracks momentum and indicates potential trend reversals.

4. Bollinger Bands

- Consist of a middle SMA and two outer bands based on standard deviation.

- Narrow Bands: Indicate low volatility and potential breakout zones.

- Wide Bands: Indicate high volatility.

Application:

Helps traders identify overbought and oversold conditions, as well as breakout opportunities.

2.3 Volume Analysis

How Volume Validates Trends:

- High volume during an uptrend or downtrend indicates strong market conviction.

- Low volume during a price rise or fall may signal a potential reversal.

Tools for Volume Analysis:

- Volume Oscillators: Measure changes in trading volume over time.

- VWAP (Volume Weighted Average Price): Combines price and volume to provide an average price level weighted by volume.

- Helps identify whether a stock is trading above or below its fair value.

Part 3: Choosing the Right Approach in Stock Market Analysis

Investors can choose between fundamental analysis, technical analysis, or a combination of both, depending on their investment goals, time horizon, and risk appetite. Here’s how to determine the right approach:

When to Use Fundamental Analysis

Ideal for Long-Term Investing

- Fundamental analysis is best suited for investors looking to build wealth over time by holding stocks for years.

- Focuses on understanding the intrinsic value of a company, which helps in identifying undervalued stocks with strong potential for growth.

Key Scenarios:

- Value Investing: Buying stocks that are trading below their intrinsic value.

- Example: Analyzing the PE ratio, EPS, and PB ratio to find undervalued companies.

- Dividend Investing: Selecting companies with consistent and growing dividend payouts.

- Sector-Specific Analysis: Understanding macroeconomic trends and their impact on industries, such as IT, pharmaceuticals, or FMCG in India.

Advantages:

- Provides a strong foundation for understanding the company’s long-term prospects.

- Helps mitigate risk by focusing on financially sound companies.

When to Use Technical Analysis

Ideal for Short-Term Trading

- Technical analysis is designed for traders seeking to capitalize on short-term price movements.

- Helps in identifying entry and exit points for trades.

Key Scenarios:

- Day Trading and Swing Trading: Using indicators like RSI, MACD, and Bollinger Bands for quick trades.

- Breakout or Reversal Strategies: Relying on chart patterns and volume analysis to predict price movements.

- Risk Management: Setting stop-loss and target levels based on support and resistance.

Advantages:

- Provides clear signals for timing trades.

- Can be used across various timeframes, from intraday to weekly charts.

Combining Both Approaches

A hybrid strategy allows investors to leverage the strengths of both methods:

- Fundamentals for Stock Selection: Use fundamental analysis to identify fundamentally strong companies worth investing in.

- Technical for Timing: Use technical analysis to decide when to buy or sell these stocks for maximum profitability.

Example of Integration:

- Use fundamental analysis to identify a fundamentally strong company with growth potential (e.g., a company with increasing EPS and low PE ratio).

- Use technical analysis to buy the stock during a bullish breakout from a resistance level or after a retracement to a support level.

Conclusion

- Recap of the Importance of Analysis:

- Fundamental analysis in Stock Market Analysis ensures that investments are based on a company’s value and financial health, making it suitable for long-term growth.

- Technical analysis in Stock Market Analysis helps in understanding market psychology, making it a powerful tool for short-term traders.

- Mitigating Risks:

- Both approaches, when used correctly, reduce the risk of emotional or impulsive decisions.

- Encouragement to Practice:

- Regular practice of these methods will improve decision-making skills.

- Use tools like financial reports, charts, and analysis software to refine your strategies.