In technical analysis, the Shooting Star candlestick pattern is a powerful indicator that can signal potential bearish reversals in the market. This blog will explore the Shooting Star pattern in detail, including its definition, identification, significance, types, trading strategies, advantages, disadvantages, and limitations. Let’s delve in.

Table of Content

What is a Shooting Star?

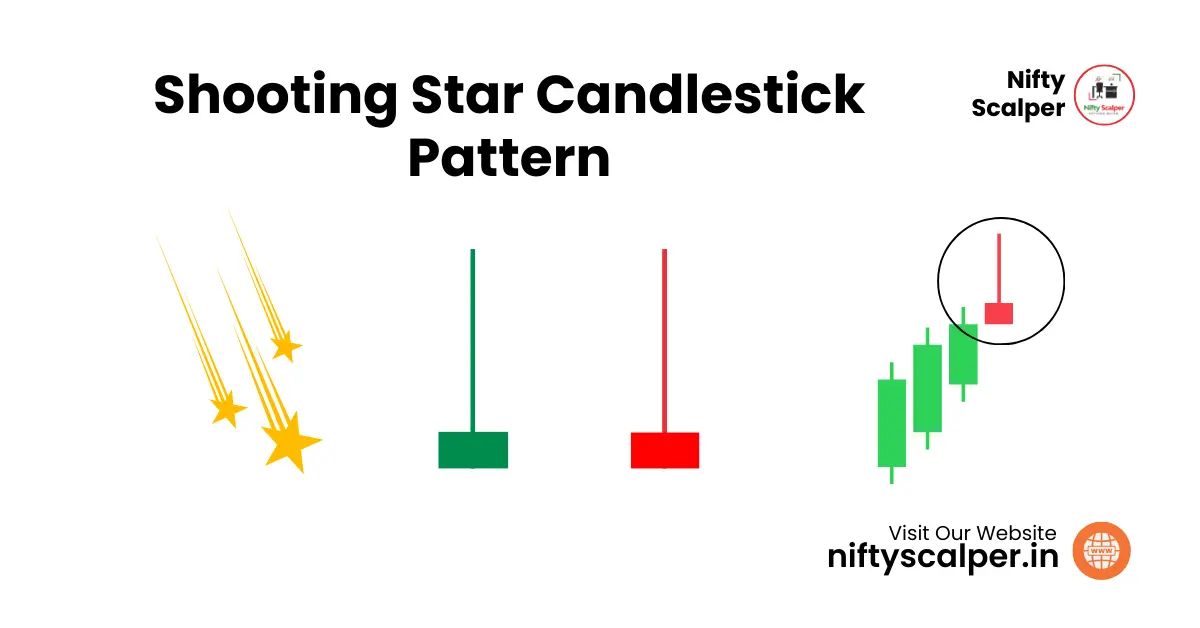

A Shooting Star is a bearish candlestick pattern that typically appears at the end of an uptrend. It is characterized by a small body at the lower end of the trading range and a long upper shadow. The pattern suggests that the market opened, rallied significantly, but then closed near the opening price, indicating a potential reversal from bullish to bearish sentiment.

How to Identify a Shooting Star Candle

To spot a Shooting Star candlestick, look for these key features:

- Body: The body is small and positioned near the low of the trading period.

- Upper Shadow: A long upper shadow that is at least twice the length of the body.

- Lower Shadow: Little to no lower shadow.

- Placement: It appears after an uptrend, signaling potential bearish reversal.

Significance of the Shooting Star in Stock Market:

- The Shooting Star pattern is significant because it indicates that the bulls are losing control and the bears may be taking over. This shift in momentum can lead to a price reversal. Traders often use this pattern to anticipate and prepare for potential market downturns.

How to Trade the Shooting Star Candlestick in Stock Market :

When trading a Shooting Star, consider these strategies:

- Confirmation: Wait for the next candlestick to confirm the bearish reversal. A strong bearish candle following the Shooting Star can validate the anticipated decline.

- Volume Analysis: Higher trading volume on the Shooting Star day adds weight to the pattern, increasing the likelihood of a reversal.

- Risk Management: Use stop-loss orders above the high of the Shooting Star to limit potential losses if the reversal does not occur.

Advantages & Disadvantages

Advantages:

- Early Signal: Provides an early indication of a potential trend reversal.

- Simplicity: Easy to identify on candlestick charts.

- Flexibility: Can be used across various timeframes and markets.

Disadvantages:

- False Signals: May give false signals if not confirmed by subsequent price action.

- Context-Dependent: Its reliability depends on the preceding trend and market conditions.

Limitations and Risks :

While the Shooting Star is a valuable pattern, it has limitations:

- Confirmation Needed: Without confirmation, it can lead to incorrect predictions.

- Market Conditions: In highly volatile markets, the pattern may appear frequently, reducing its reliability.

- Over-Reliance: Relying solely on the Shooting Star without other indicators can result in poor trading decisions.

Conclusion:

The Shooting Star candlestick pattern is a crucial tool for traders, indicating potential bearish reversals at the end of uptrends. By understanding how to identify and interpret this pattern, and considering its advantages and limitations, traders can enhance their technical analysis and make more informed trading decisions. Remember, while the Shooting Star is informative, it should be used alongside other analysis tools to mitigate risks and improve accuracy.

By incorporating the insights provided by the Shooting Star pattern, traders can better navigate the complexities of the financial markets and improve their trading outcomes.

Remember, successful trading is not just about mastering Shooting Star Candlestick; it’s about combining them with Risk Management, Discipline, and Continuous Learning to get the best results in the stock market.